Business Banking

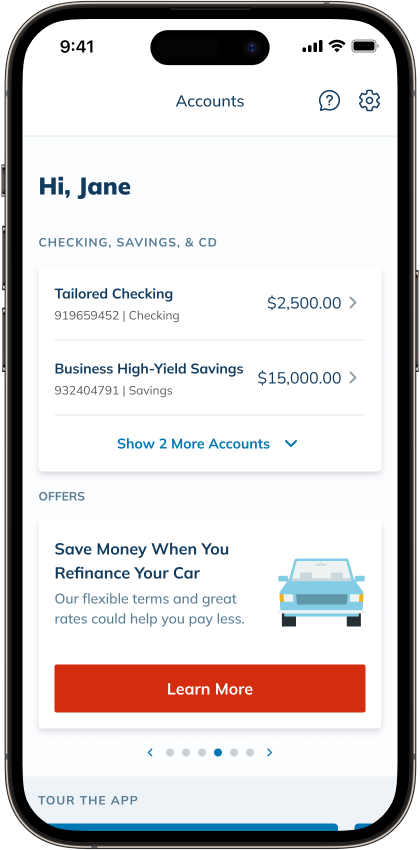

YOUR NEW TAILORED CHECKING ACCOUNT

Congratulations on opening your new account!

Getting Started

Sign in to Online Banking

Start enjoying the features of your new account right away by creating your personalized credentials and signing in to Online Banking. Please note that while your Tailored Checking account is a business account, your account will be displayed under your name in Online Banking.

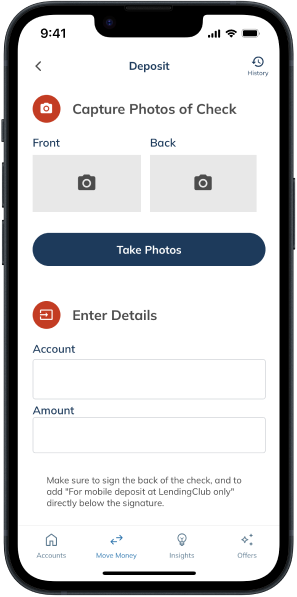

Download the LendingClub Mobile App

Get the LendingClub Mobile app to manage your account and deposit checks from anywhere.1

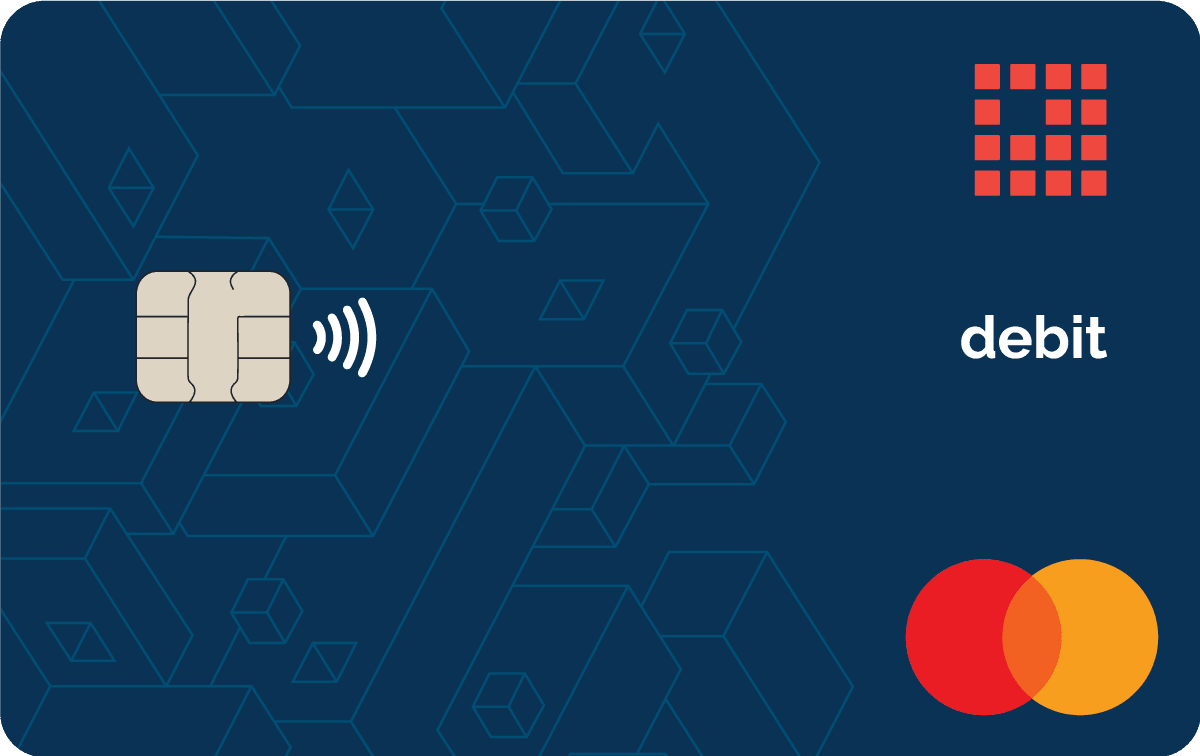

Debit Card

If you ordered a business debit card as part of your application, you should receive it within 7-10 business days. If you did not order a debit card and would like one, please contact Customer Service.

Opening Deposit

You’ll see the funds used to open your account posted to your account within 2-3 business days. The deposit is held for 5 business days for your security.

Manage Your Business

Add Users to Online Banking

Sign in to Online Banking and select Tools from the menu header, then choose Access Manager and complete the Add a New User section. Enable access to accounts and features as well as restrict views by account type.

Ordering Additional Debit Cards

To order additional debit cards for your employees, please call Customer Service.

Account Features

Send a Wire

Domestic Wires under $10,000 can be originated directly within Online Banking. For wires larger than $10,000 please contact Customer Service.

ATM Fee Rebates

LendingClub never charges its clients to use an ATM, but other ATM owners may charge a fee. Tailored Checking accountholders are reimbursed each month for ATM fees charged by other financial institutions. At the end of each month, we calculate the amount in ATM fees you incurred during the month and automatically rebate your account.2 No forms to submit, no receipts to keep, it’s that easy.

Shared Deposit ATMs

LendingClub is part of a shared deposit ATM network, MoneyPass, which allow Tailored Checking account holders the ability to make deposits at ATMs of other institutions that participate in the program.

Find a MoneyPass Deposit Taking ATM

Mobile Check Deposit

No time to go to the ATM? Deposit your check from anywhere using the LendingClub Mobile app.

Funds Transfer

Link an external account within Online or Mobile Banking for free funds transfers. Please note, that the initial setup of an external account may take up to 3 days.