PERSONAL BANKING

Rewards Checking

Earn unlimited 1% cash back1

Receive unlimited ATM fee rebates2

No monthly maintenance or overdraft fees

No minimum balance or transaction requirements

Bank Smarter with LendingClub

Make the most of your money with LendingClub, recently awarded Best Online Bank for 2024 by GOBankingRates. Our superior products and services are built to help you reach financial wellness, including our award-winning checking account, Rewards Checking, offering 1% cash back, ATM rebates and more.

Account Features

Unlimited Cash Back

Free Access to ATMs

Get Paid Early

Freedom from Fees

Earn Interest

FDIC Insurance

Our Customers Earned $20 on Average Per Month in Benefits6

Get money deposited back into your account each month:

Earn cash back on Qualified Purchases (signature-based purchases) made with your Rewards Checking debit card.

Free ATM Transactions: We rebate ATM fees charged by other banks.

Interest-Earned.

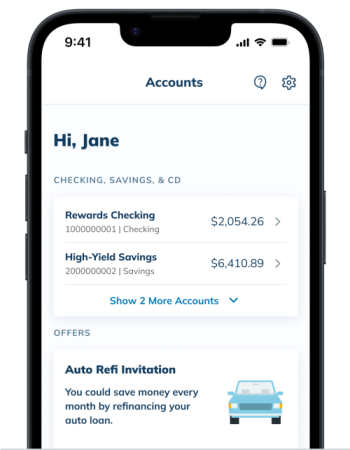

Bank from Anywhere with LendingClub Mobile

A full-service bank at your fingertips5

Available for iOS and AndroidTM

Deposit checks

View real-time transactions

Pay bills and transfer funds

Manage your budget and track spending

At LendingClub, we put our customers at the center of everything we do. That’s why we focus on providing products and services that are not only convenient but help to make life easier.

You can apply online for a checking account, savings account, or CD by heading to our Personal Banking page. From there, select the account you’re interested in and click “Learn More.” After going to the product page of the account you are interested in, click on “Apply Online” to start filling out the application. Then, enter your personal information, verify your information, review and agree to disclosures, and fund your account. You will receive confirmation at the end of the application if your account has been approved. If not, you will receive an email notification.

To open an account, you need to be a citizen or resident of the United States.

Please have the following information available when you begin your application:

Your Social Security number

Your current residential address

Your email address

Your account number or debit card from another financial institution to make your opening deposit into your new Rewards Checking account

You will need to fund the account with a minimum of $25.

You can apply for and open a Rewards Checking account entirely online in under 3 minutes, start to finish.

To complete the account opening process a $25 minimum opening deposit is required. You can add additional funds to your account at a later time by signing into online banking and setting up a funds transfer.

LendingClub does not pull credit as part of our account opening process. However, we do obtain information from a credit bureau used to validate your personal information. The request for information does not affect your credit score.

There is no monthly maintenance fee for a Rewards Checking account. For fees that may apply to your account, go to the Product Terms and Conditions page to learn more.

There is no monthly minimum balance requirement for your Rewards Checking account.

If requested during account opening, your debit card should arrive within 7-10 business days once your application has been approved. If you did not request a debit card upon account opening and would like to order one, please call Customer Service at 800-242-0272 or use Secure Message within online banking.

You can only apply for an account if you are 18 or older. You must also be a citizen or resident of the United States.

Yes! To open a joint account, you will check the “I want to make this a joint account” box on the Basic Info page of the application. You’ll need the same information that’s needed when opening an individual account, but you’ll need it for both applicants. You can also make a single account a joint account after the account is opened by contacting Customer Service.

You can withdraw funds from the account in three ways.

Use your LendingClub debit card to withdraw funds free of fees at a MoneyPass or SUM ATM location Locate an ATM.

Make an external transfer (ACH) to another financial institution for no fee. You can add an external account by selecting “Manage External Accounts” from the Transfer page within Online Banking or the LendingClub Mobile app.

Elite and Reserve accountholders can place a wire via online banking and our mobile app. For all other customers, you can reach out to customer service here to initiate a wire. Please note there is a fee to send a wire. View Product Terms and Conditions.

You are able to deposit cash at any MoneyPass Deposit Taking ATMs.

Yes we do and your first order of checks (25) is free! To order, reach out to Customer Service via Secure Message or by phone.

To earn interest on your Rewards Checking account, you must keep a balance of $2,500 or more within the account. The more money you have in your account, the more interest you will earn. At the end of each month, the interest payment will be deposited into your account.

To make your initial deposit, you can transfer money from your account at another financial institution using your account and routing number. Please ensure that you have sufficient funds available to be transferred. Your initial deposit may be held for 5 business days after the receipt of funds.

You must have a Rewards Checking account open for at least 30 days, and either receive $2,500 worth of recurring direct deposits into your account from an employer or another source of income or keep an average monthly balance of $2,500 or more in your account. Cash back is only available for Qualified Purchases made with a Rewards Checking debit card.1

Tip: When shopping in store select “credit” instead of “debit” at the point-of-sale where available to ensure you receive the cash back. The cash back you earn will automatically be credited to your account at the end of the month following the earning period.

There are two ways a debit card can be processed at the time of a purchase.

The first option is called the “debit/online/PIN debit” method, where you enter your PIN at the point of sale and the funds are immediately debited from your account.

The second option is called the “credit/offline/signature debit” method, where you select the “credit” button, sending the transaction through the credit card processing network. A hold is placed on the money for the transaction in your account, which clears or processes in a day or two. You have to use this debit function if you want to receive cash back during your transaction. It is important to note that when you are using your debit card for online purchases, your card will automatically run as a credit transaction.

Yes, when you use your LendingClub debit card for an online purchase your card will automatically run as a credit transaction, making the purchase eligible for cash back should your account meet the qualifications.

The cash back you earn will automatically be credited to your Rewards Checking account at the end of the month following the earning period, for each month that qualification requirements are met.