Your finances matter to you, and that matters to us

Keep more of what you earn and earn more on what you save.

We’re rewriting the rules of traditional banking, and we only win when our customers succeed. We’ve helped over 4 million members reach their goals, and we’re just getting started!

Bank Smarter with LendingClub

Make the most of your money with LendingClub, recently awarded Best Online Bank for 2024 by GOBankingRates. Our superior products and services are built to help you reach financial wellness, including our award-winning checking account, Rewards Checking, offering 1% cash back, ATM rebates and more.

LendingClub is the leading digital marketplace bank in the U.S., connecting borrowers with investors since 2007. Our LC™ Marketplace Platform has helped more than 4.8 million members get over $90 billion in personal loans so they can save money, pay down debt, and take control of their financial future.

And because we don’t have any brick-and-mortar locations, we’re able to keep costs low and pass the savings back to you in the form of great interest rates. Learn more about our personal loan rates.

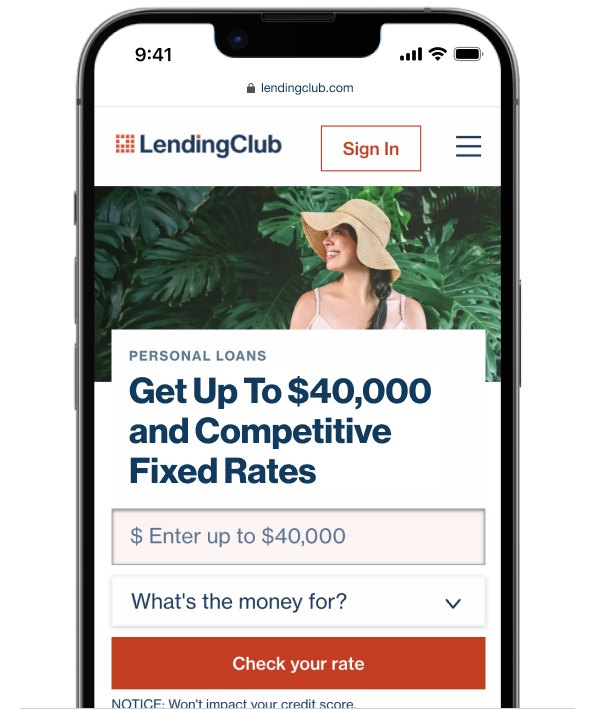

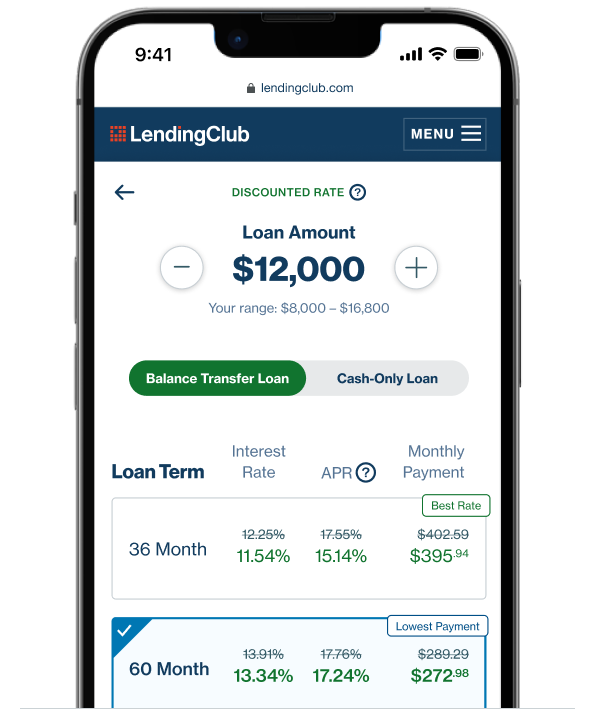

A personal loan is money lent through a financial institution like a bank or an online lending marketplace that can be used to pay down credit cards, consolidate debt, or cover a wide range of expenses. Personal loans come with fixed monthly payments over a set period of time.

Instead of credit limits, introductory rates, or revolving balances, personal loans come with a fixed rate and payment that you choose up front. No additional interest will be added to your loan once you lock in your rate, so nearly all of your monthly payment goes to quickly reducing your balance and paying down your debt. Learn more about personal loans vs. credit cards.

Checking your rate with LendingClub Bank has absolutely no impact to your credit score because we use a soft credit pull. A hard credit pull that could impact your score will only occur if you continue with your loan and your money is sent. The good news is that a personal loan could also positively impact your credit down the road by showing a history of on-time payments and reducing your total debt (as long as you don’t add new debt, like increased credit card balances). Learn more about soft vs. hard credit check.

Scammers often try to collect personal and/or financial information from consumers by posing as employees of philanthropic organizations or financial services companies. Be cautious about providing personal or financial information to anyone, even if they claim to be from a company you already do business with. Learn about the advance fee scam.